Outstanding Info About How To Sell Gap Insurance

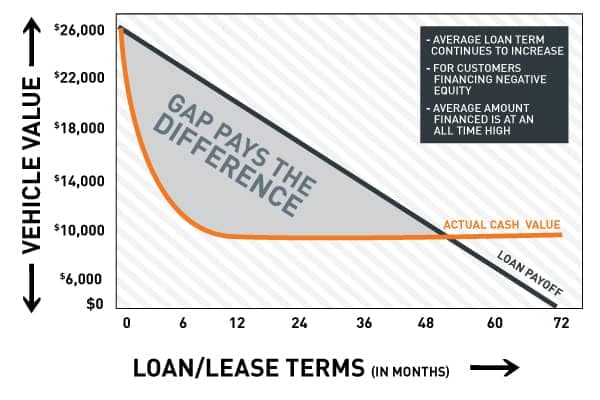

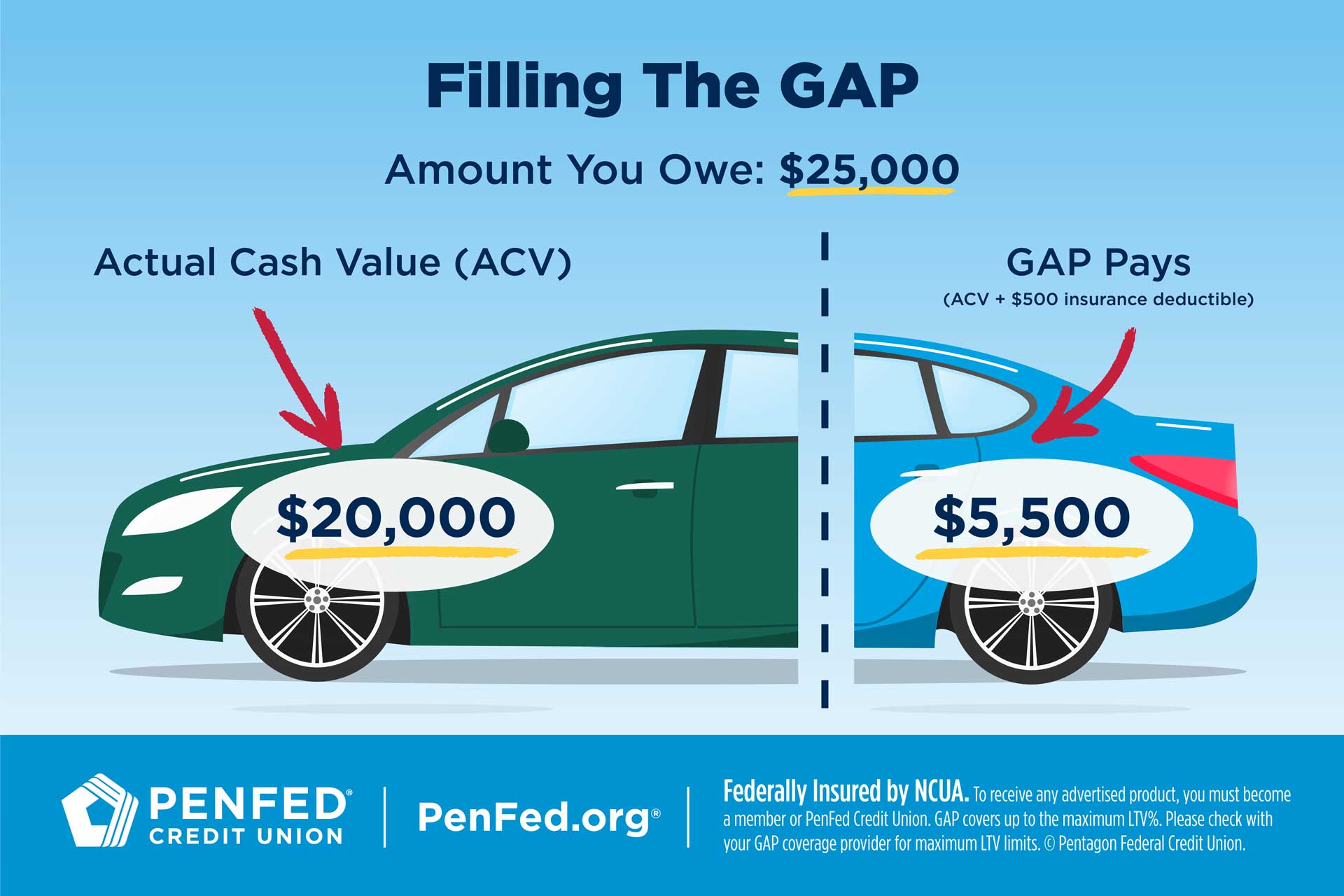

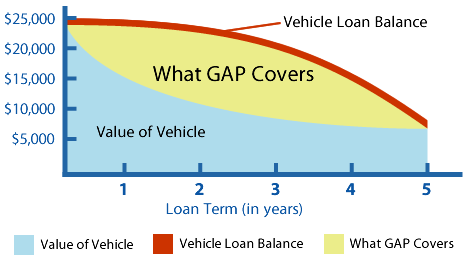

The value of the loan or lease no longer exceeds the actual cash value of the vehicle.

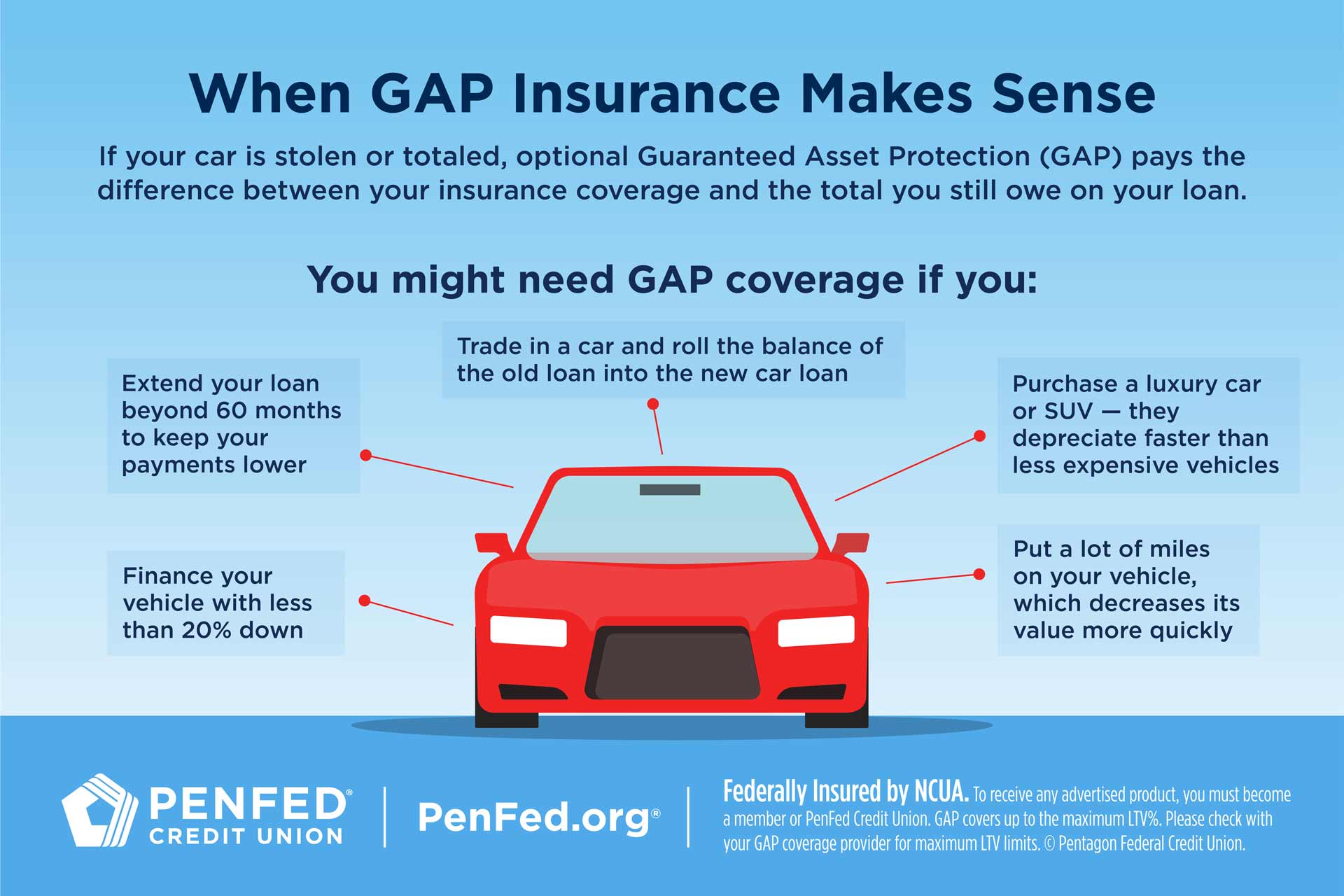

How to sell gap insurance. Take the total cost of your gap insurance, and divide it by the number of months you had coverage. What auto dealerships commonly offer is most likely a debt waiver. Buying gap insurance from an insurance company may.

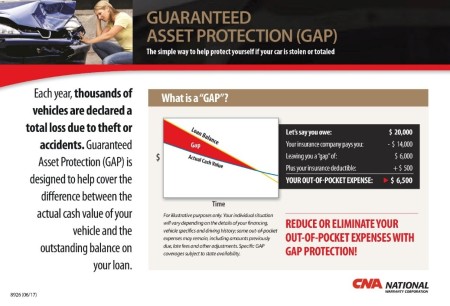

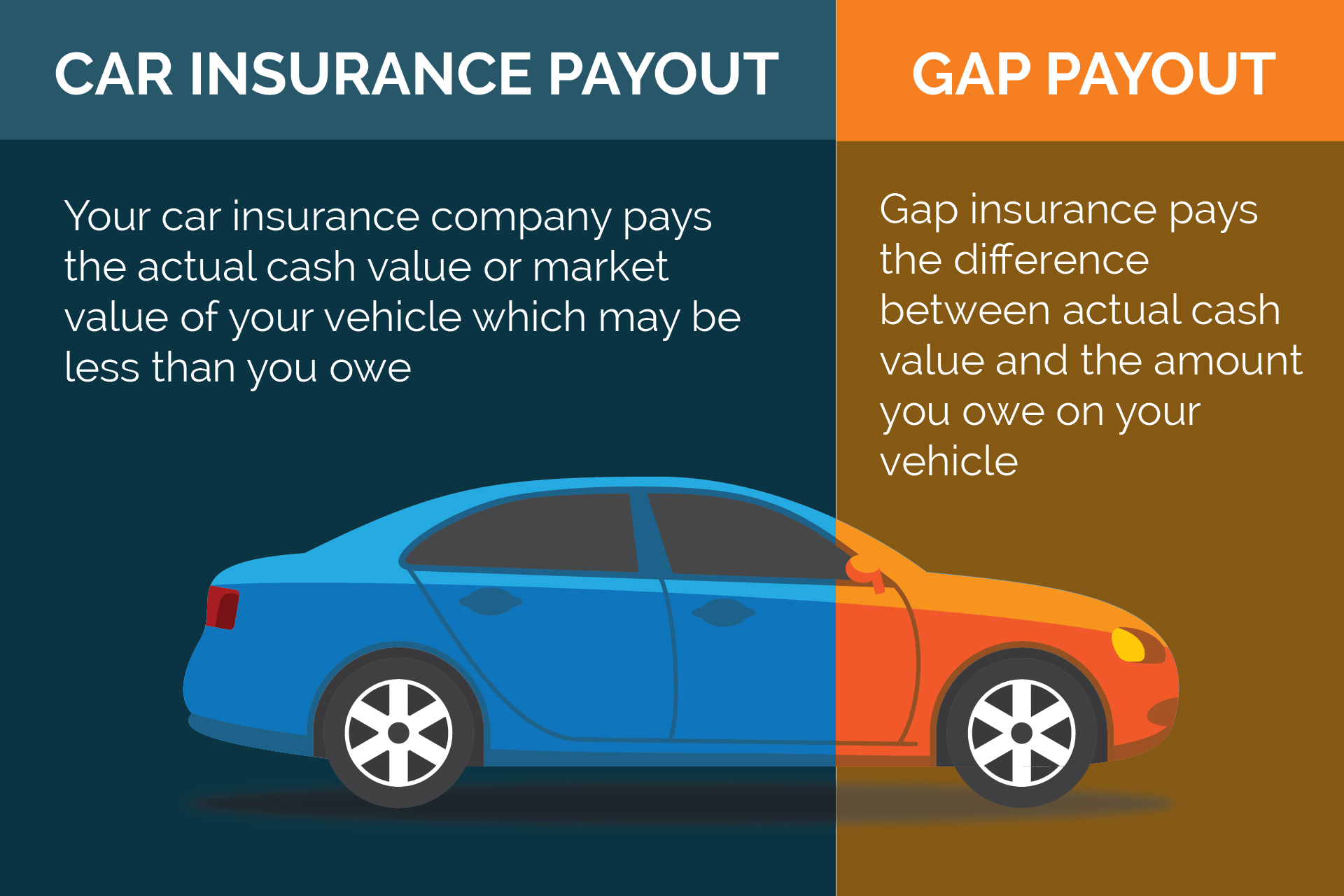

Gap insurance is meant to be used in conjunction with collision coverage or. Nationwide’s gap insurance may cover some, or all, of that amount. Protection for new and used vehicles valued or.

The two structures of gap are waiver/addendum and insurance. So, for example, suppose you bought gap insurance. Gap insurance costs between $400 and $700 when purchased from a dealership and between $20.

Car dealers sell gap insurance when you purchase a vehicle from a car dealer and sign the finance papers with them, one thing that they will offer to you is gap insurance. Insurance companies, on the other hand, charge an average of $20 to $40 per year for gap insurance when buyers bundle it into an existing insurance policy. True to its name, a gap insurance refund reimburses insurance policy holders for the balance of the premium that’s unused.

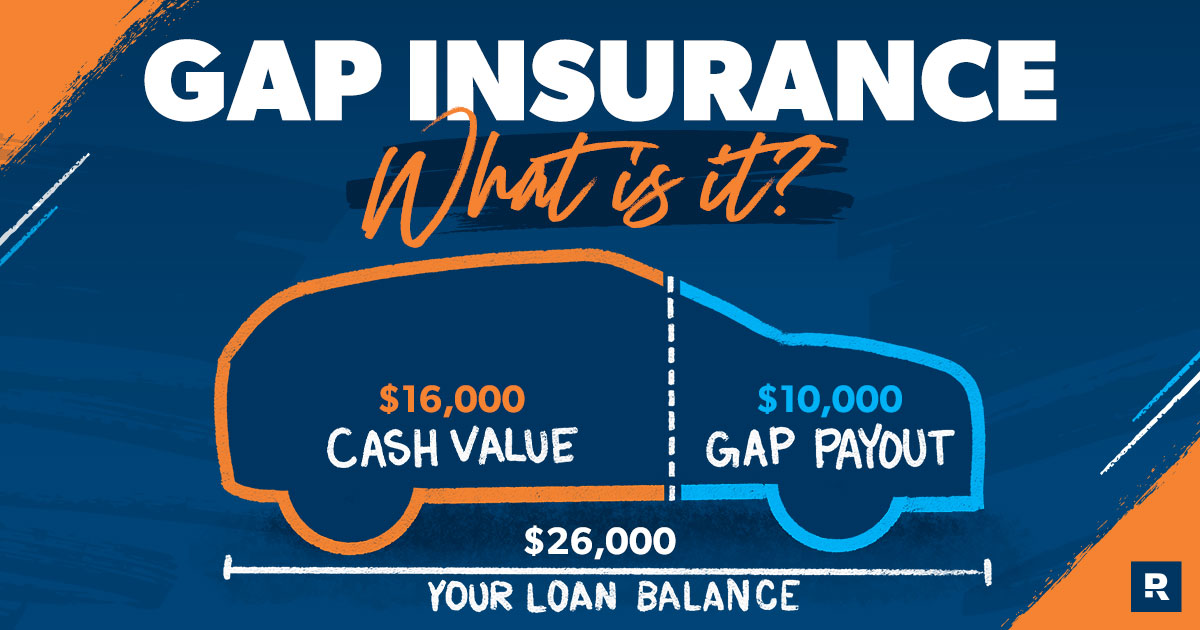

Then, multiply the monthly premium by the number of months you have left. Auto dealerships and/or lenders may try to sell you what they call gap insurance, but it's not actual insurance. Car dealers often used to try to sell gap insurance to their customers alongside the car sale itself.

You can typically add gap coverage to an existing car insurance policy or a new policy, as long as your loan or lease hasn't been paid off. Let’s say your car cost $35,000 when. In some cases, financing companies and lease contracts require the.