Unique Info About How To Sell Call Options

![How To Sell A Call Option - [Option Trading Basics] - Youtube](https://www.vantagepointsoftware.com/wp-content/uploads/2020/05/covered-call-understanding-options.png)

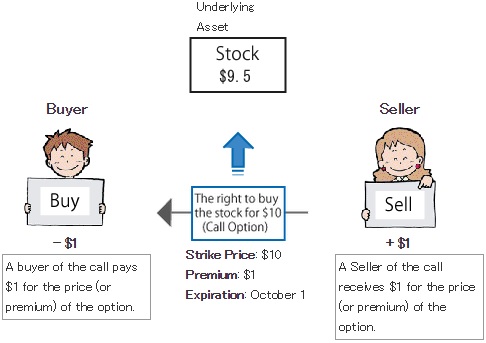

Selling calls the purchaser of a call option pays a premium to the writer for the right to buy the underlying at an agreed upon price in the.

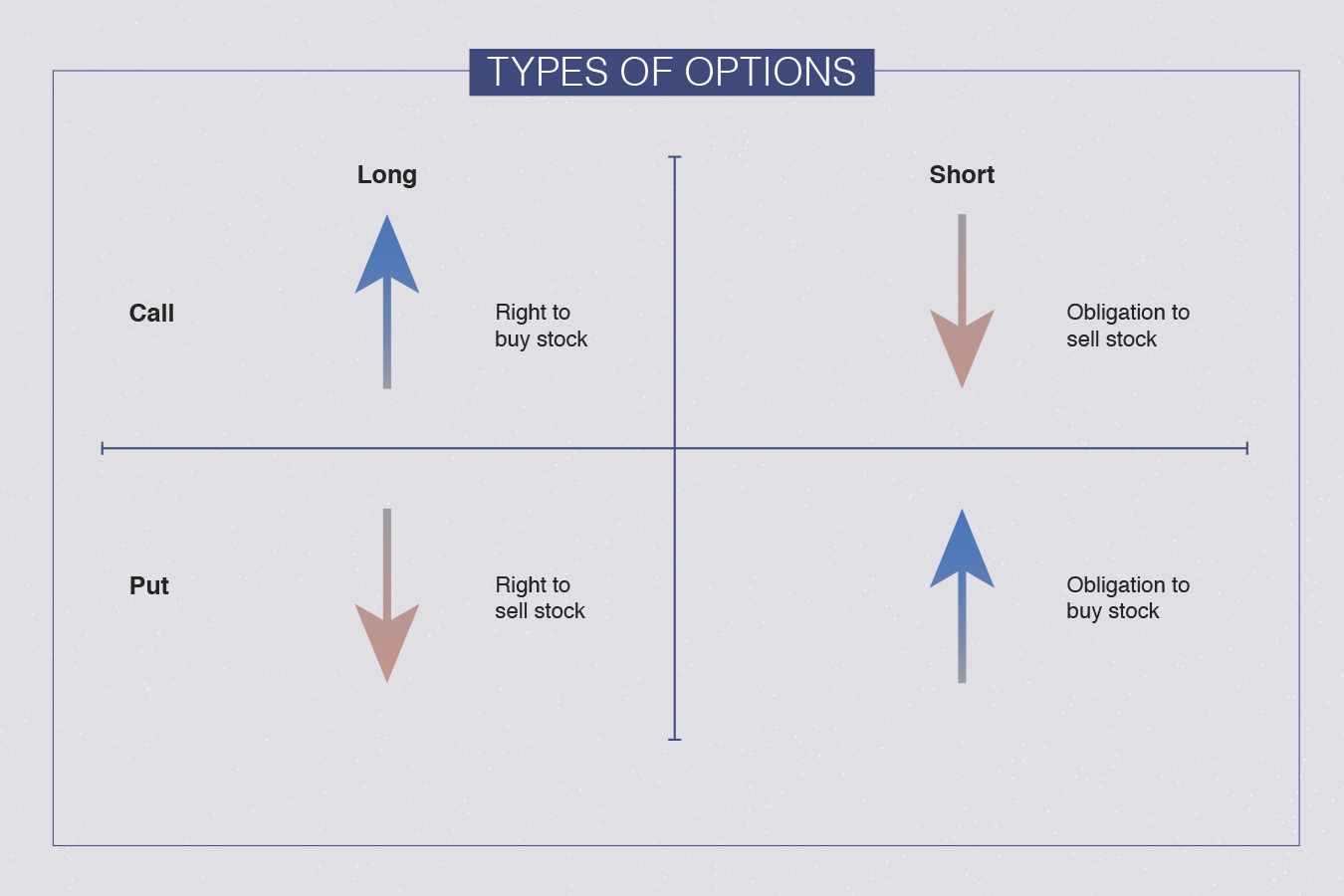

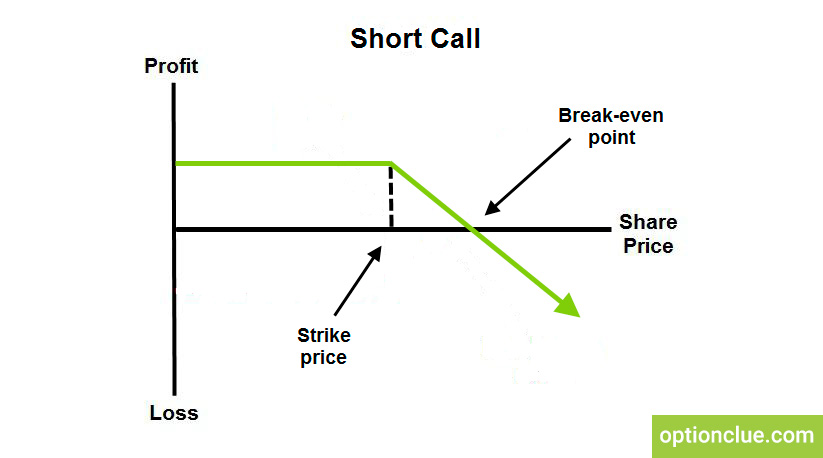

How to sell call options. Conversely, buying a put option gives the owner the right to sell the underlying security at the option exercise price. Covered call options are an easy source of passive income! You are selling the call (you’re short, buyer is long) to an options buyer because your believe that the price of the stock is going to fall, while the buyer believes it is going up.

With a covered call, a trader makes two actions: This part is the same no matter. Buying a call option, selling a call option, buying a put option, and selling a put option.

Then, he or she would make the appropriate selections (type of option, order type, number of options, and expiration month) to place the order. How does selling a call option work? The profit the buyer makes on the option.

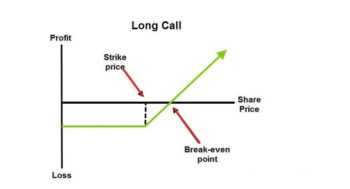

For review, a call option gives the buyer of the option the right, but not the obligation, to buy the underlying stock at the option. You determine the price at which you’d be willing to sell your stock. Selling a call is not as easy as it might seem due to order types (e.g., open or close).

A put option gives the buyer the right to sell the underlying asset at the option strike price. I will walk you through the sell option method in etrade. Find the stock you’d like to sell a call option for.

Choose the underlying symbol, then enter the specific option order details (type, expiration, strike price, number of contracts, etc.). To do so, tap the magnifying glass in the top right corner of your home screen. You sell a call option consisting of the right to purchase 100 shares of a stock before the expiration date of the contract for a set price.

:max_bytes(150000):strip_icc()/Clipboard01-617b9d39bcc744d691fc612f569587e0.jpg)

![How To Sell A Call Option - [Option Trading Basics] - Tradersfly](https://tradersfly.com/wp-content/uploads/2019/06/2017-07-27-selling-call-options-single-296.jpg)

:max_bytes(150000):strip_icc()/NakedCallWriting-AHighRiskOptionsStrategy2_2-aab223af50cc44ba9a0f874609356225.png)

![How To Sell A Call Option - [Option Trading Basics] - Youtube](https://i.ytimg.com/vi/SAgkEWTGTDw/maxresdefault.jpg)

:max_bytes(150000):strip_icc()/CoveredCall-943af7ec4a354a05aaeaac1d494e160a.png)

/Clipboard01-617b9d39bcc744d691fc612f569587e0.jpg)

![How To Sell A Put Option - [Option Trading Basics] - Tradersfly](https://tradersfly.com/wp-content/uploads/2019/06/2017-07-27-selling-put-options-single-263.jpg)